Introduction

In today’s fast-paced world, health insurance is an important part of both financial and personal safety. People are looking for insurance companies that are cheap, clear, and easy to use because medical expenditures are going up, healthcare needs are changing, and people are using digital services more and more. Oscar Health Insurance is a new choice that focuses on making health coverage easier while putting the user experience first. This page goes into great detail about Oscar Health Insurance, including its plans, benefits, costs, eligibility, and how it fits into the changing healthcare market.

Oscar Health Insurance is known for using technology to make healthcare more accessible and less confusing. The company has set itself up as an alternative to traditional insurers by offering digital tools and specialized care teams. People and families may decide if it meets their healthcare needs and budget by learning how it works.

Getting to Know Oscar Health Insurance

The premise behind Oscar Health Insurance is that health insurance should be simple, not hard to understand. Traditional insurance models frequently include a lot of paperwork, aren’t very clear, and take a long time to help customers. This insurance company, on the other hand, puts a lot of emphasis on making things easier to use, communicate, and manage care.

Oscar Health Insurance’s main idea is that people should get preventive care, be able to easily see a doctor, and know exactly what their plan covers. Policyholders are encouraged to use their health coverage more than just in emergencies. This method helps people make smart choices about their health care and stay healthy over the long run.

The focus on technology is another important part. Mobile apps, online dashboards, and virtual consultations are some of the most important parts. The goal of these tools is to make it easier to make appointments, check claims, or comprehend benefits by cutting down on the time and stress involved.

Oscar Health Insurance Offers Different Types of Plans

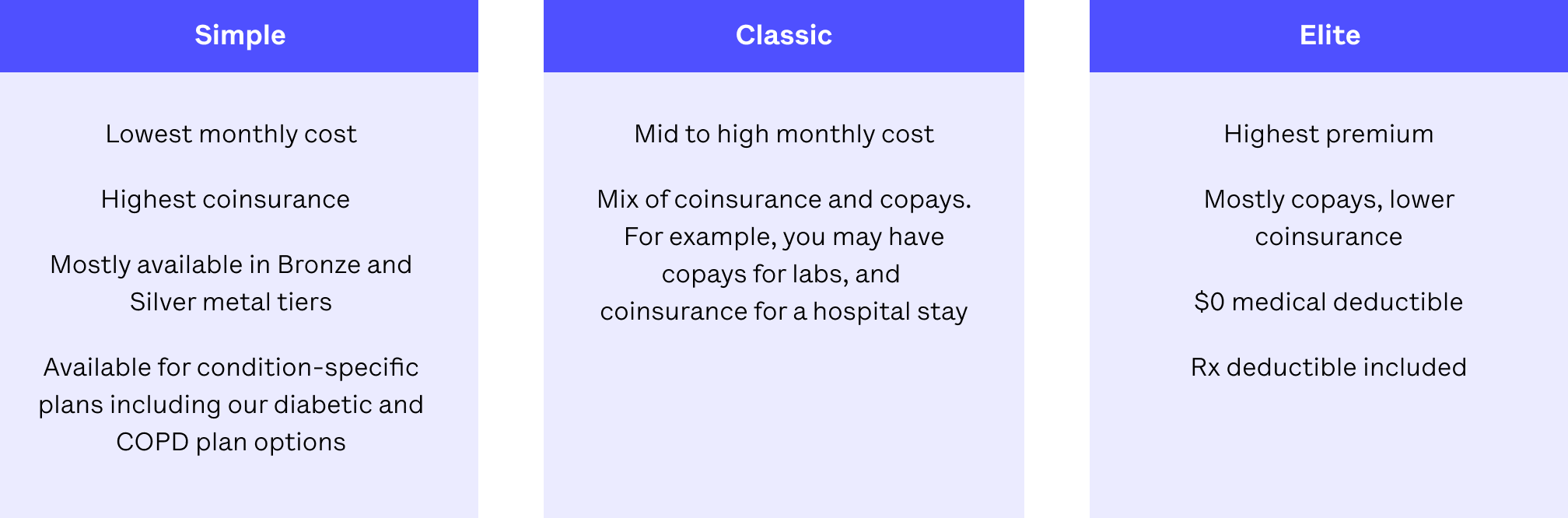

Oscar Health Insurance offers a number of plans that are meant to fit different demands and budgets. Most of the time, these plans are set up to meet marketplace criteria, which makes them available to a lot of people.

Plans usually differ according on the monthly premiums, deductibles, and out-of-pocket payments. Some plans are for people who want lower monthly payments but can handle larger deductibles. Others are for those who use medical services a lot and want prices that are easy to forecast. Customers can choose coverage that fits their health needs and budget because of this flexibility.

Outpatient treatment, hospitalization, prescription medications, preventive services, and mental health support are all common types of health benefits that are covered. Oscar Health Insurance wants to make sure that clients aren’t paying for coverage they don’t need while still getting full protection by giving them structured choices.

Important Benefits of Oscar Health Insurance

One of the main reasons people choose Oscar Health Insurance is the many perks it offers in addition to basic coverage. These benefits are meant to make things easier, more accessible, and more satisfying overall.

The fact that virtual care services are available is a big plus. Policyholders can talk to doctors and nurses about common health problems over the phone or online, which can save time and money. This is especially helpful for people who have busy schedules or can’t easily go to local providers.

Another big benefit is that it helps with preventive care. A lot of plans stress getting regular exams and finding problems early on. This can assist keep significant health problems from happening in the future. Oscar Health Insurance enhances long-term health outcomes and lowers the chance of needing expensive treatments later by encouraging people to take steps to stay healthy.

Customer service is also set up to be more personable. Care teams help members understand their plans, benefits, and how to select the right providers. This advice helps clear things out and fosters trust between policyholders and their insurance company.

Costs and Things That Affect Affordability

When picking health insurance, cost is quite important. Oscar Health Insurance wants to find a balance between cost and coverage by delivering low premiums and straightforward pricing structures. The amount you pay each month for your plan depends on the type of plan you have, how much coverage you need, and your own situation.

Members can see clearly what their out-of-pocket expenditures will be, including as deductibles, copayments, and coinsurance. This lets them know what to expect. This openness helps people better plan how much they will spend on health care.

Eligibility for subsidies or tax credits can affect how affordable something is for many people. People with low or middle incomes may be able to get financial help with Oscar Health Insurance plans sold through marketplaces, making coverage easier to get. When figuring out how affordable something is, it’s important to know about these possibilities.

Table 1: A List of Common Features of Oscar Health Insurance Plans

| Feature Category | Description |

|---|---|

| Plan Types | Individual, family, and marketplace-compliant plans |

| Preventive Care | Routine checkups, screenings, and wellness visits |

| Virtual Services | Online consultations and digital health tools |

| Prescription Coverage | Access to a range of medications |

| Customer Support | Personalized care teams and digital assistance |

Who Can Apply and How to Apply

Your location, age, and enrollment periods are some of the things that determine whether you can get Oscar Health Insurance. People and families looking for health insurance through health insurance marketplaces or qualifying enrollment windows can usually find plans.

The enrolling procedure is meant to be easy for users, and people often do it online. Applicants give basic biographical and financial information to find out what plans are available and what financial help they might be able to get. Members can use digital tools and plan materials right away after signing up.

People who go through qualifying life events like getting married, moving, or changing jobs may be able to join during special enrollment periods. Understanding these regulations makes sure that candidates don’t miss chances to get coverage when they need it most.

Access to Networks and Providers

When choosing insurance, it’s important to think about how easy it is to get to healthcare providers. Oscar Health Insurance operates with certain networks that include doctors, hospitals, and clinics. These networks are meant to provide good treatment while keeping prices down.

Members are encouraged to pick providers in the network to get the most advantages and pay the least out of pocket. Digital technologies make it easier for members to find in-network doctors and facilities, which helps them make smart choices about their treatment.

The size of the network may change from place to place, but the goal is to keep solid relationships with trustworthy providers. This method helps make sure that members get the right care when they need it and that care is always the same.

Combining Digital Tools and Technology

Oscar Health Insurance is known for its use of technology. The organization stresses digital engagement to make the insurance process easier. Members can easily manage their coverage through mobile apps and internet platforms.

Users can make appointments, get virtual care, go over claims, and keep track of their healthcare expenses with these capabilities. This amount of openness makes things less unpredictable and gives members more power over their health decisions.

Also, notifications and reminders are quite vital. Members get reminders about their next appointments, screenings, and plan changes. These features help people manage their health better and stick to the care that is prescribed.

Help with Mental Health and Wellness

More and more people are realizing that mental health coverage is an important part of overall health. As part of its full coverage, Oscar Health Insurance offers mental health services.

Most of the time, those who have insurance can get therapy, counseling, and mental health services. Virtual mental health consultations make things even easier by letting people get help without having to worry about how to get there.

Wellness programs that promote healthy habits and stress management may also be part of the package. Oscar Health Insurance takes a comprehensive approach to care by taking care of both physical and emotional health.

Table 2: A look at the different costs of Oscar Health Insurance Plans

| Cost Component | Explanation |

|---|---|

| Monthly Premium | Regular payment to maintain coverage |

| Deductible | Amount paid before insurance coverage begins |

| Copayment | Fixed fee for specific services |

| Coinsurance | Percentage of costs shared after deductible |

| Out-of-Pocket Maximum | Annual cap on total personal expenses |

Customer Service and Support Structure

Customer service is a big factor that sets health insurance companies apart from each other. Oscar Health Insurance puts a lot of importance on clear communication and responsive service.

Members can get help through digital channels, phone support, or care teams that are designated to aid with specific needs. This framework is meant to make things less frustrating and more satisfying by giving people timely and useful advice.

There are other ways for users to give feedback, which lets the corporation change its services based on what users say. This method of constant improvement helps make sure that coverage stays in line with what customers want.

Things to Think About: Pros and Cons

Oscar Health Insurance is like any other insurance company in that it has pros and cons. To make a smart choice, you need to know about these things.

Some benefits are easier access to digital services, a focus on preventive care, and clear pricing. People who value convenience and clarity will like these things.

But there may be some constraints, such network restrictions in some areas or plans that aren’t available in all areas. Potential customers should carefully read the plan specifics and provider networks to make sure they meet their healthcare needs.

How Oscar Health Insurance Meets Today’s Healthcare Needs

Technology, consumer expectations, and cost pressures are all changing the healthcare sector very quickly. Oscar Health Insurance is in line with these trends by providing solutions that put accessibility and engagement first.

The addition of virtual care shows how much more people want healthcare services that can be done from home. Digital management technologies meet the need for openness and speed. Preventive care programs can keep people healthy in the long run and keep costs down.

Oscar Health Insurance is a forward-thinking choice for people who want a more engaging insurance experience because it keeps up with current developments.

How to Choose the Best Plan with Oscar Health Insurance

Choosing the best health insurance plan means carefully considering your needs, your budget, and how often you need healthcare. Oscar Health Insurance has a lot of different plans to choose from, so it’s crucial to compare them carefully.

People who don’t need a lot of medical treatment may care more about reduced premiums, while people who have long-term problems may worry more about full coverage and predictable expenses. Checking the benefits, provider networks, and cost structures of the plan you choose helps make sure it is worth the money.

Getting help and information from various resources and support teams can make the decision-making process even easier. Making informed choices leads to better health and happiness.

What Will Happen to Oscar Health Insurance in the Future

Oscar Health Insurance will probably add more digital features and services as the healthcare industry changes. Ongoing innovation could lead to better virtual care alternatives, better data analytics, and more individualized health advice.

The focus on user experience and preventive treatment shows that modern healthcare delivery is here to stay. The company can keep addressing the needs of customers as they change by being flexible.

Policyholders can better plan for how their coverage may change over time and stay useful in a healthcare system that is always changing by keeping up with current changes.

In conclusion

Oscar Health Insurance is a new way to get health insurance that uses technology, openness, and individualized help. It is a different kind of insurance plan that focuses on preventive treatment, digital involvement, and explicit cost structures.

Oscar Health Insurance is a great choice for people and families who want health insurance that is easy to use and understand. Carefully looking at plans, pricing, and provider networks makes ensuring that coverage fits with personal health goals.

As healthcare systems change, this insurer’s focus on innovation and the experience of its members makes it a major player in the changing insurance market.

Read More:- Mental Health Awareness: Understanding, Importance, Challenges, and the Path to Well-Being