Introduction

The health insurance marketplace is very important for helping people and families get health insurance that they can afford. It was made to give customers a clear, organized approach to compare health insurance plans, learn about features, and pick coverage that meets both their medical and budgetary needs. The health insurance marketplace has become one of the most essential instruments for those who don’t get insurance through their job or a government program throughout time.

This in-depth overview goes over how the health insurance marketplace works, who it is for, the different sorts of plans that are offered, how costs are figured out, and what benefits people may expect. People may make smart choices and avoid gaps in health care if they fully understand the system.

What is the Marketplace for Health Insurance

The health insurance marketplace is a well-organized area where persons, families, and people who work for themselves can look for health insurance policies. Private insurance firms offer these policies, but they all follow the same regulations to make sure that coverage is fair and consistent. The health insurance marketplace was made to make it easier to buy insurance by putting many plans in one spot next to each other.

One of the most important things about the health insurance marketplace is that all plans must offer basic health benefits. This makes sure that customers have real coverage instead of insurance policies that are limited or insufficient. The health insurance marketplace also helps those who qualify get financial help, which makes coverage more reasonable.

What the Health Insurance Marketplace Is For and Why It’s Important

The health insurance marketplace’s principal goal is to make it easy to understand and buy insurance so that more people can get the treatment they need. Before it came out, a lot of customers had trouble comparing plans or couldn’t get coverage because of pre-existing diseases. The health insurance marketplace altered this by putting in place protections for consumers and rules for coverage that are the same for everyone.

Another significant thing that the health insurance marketplace does is encourage preventive care. Screenings, wellness checkups, and vaccinations are common covered services. These services assist lower long-term healthcare expenditures and enhance public health outcomes. The health insurance marketplace helps make communities healthier by encouraging early treatment and preventive treatments.

Who Can Use the Marketplace for Health Insurance

People who can’t get cheap health insurance via their jobs can use the health insurance marketplace. This includes freelancers, gig workers, small business owners, part-time employees, those who have just retired, and people who are between jobs. When their employer’s health insurance doesn’t fit their needs, a lot of families also use the health insurance marketplace.

Most of the time, your residency status and income level determine if you are eligible. Income does not stop someone from buying insurance through the health insurance marketplace, but it does decide if they may get subsidies that cut their monthly payments or out-of-pocket expenditures. One of the best things about the system is that it helps people based on their income.

Different Kinds of Health Insurance Plans

There are multiple metal tiers for plans that are available through the health insurance marketplace. These tiers show how the policyholder and the insurer split the costs, not the quality of care.

Types of Health Insurance Plans

| Plan Category | Cost Sharing Level | Typical Premium | Out-of-Pocket Costs |

|---|---|---|---|

| Bronze | Lower coverage share | Lowest | Highest |

| Silver | Moderate coverage share | Moderate | Moderate |

| Gold | Higher coverage share | High | Lower |

| Platinum | Highest coverage share | Highest | Lowest |

Bronze plans normally feature lower monthly premiums but higher deductibles. This makes them a good choice for folks who don’t need medical treatment very often. People choose silver plans because they balance monthly expenditures with costs that come out of their own pockets. People who intend to go to the doctor often or need continuing treatment should choose Gold or Platinum plans.

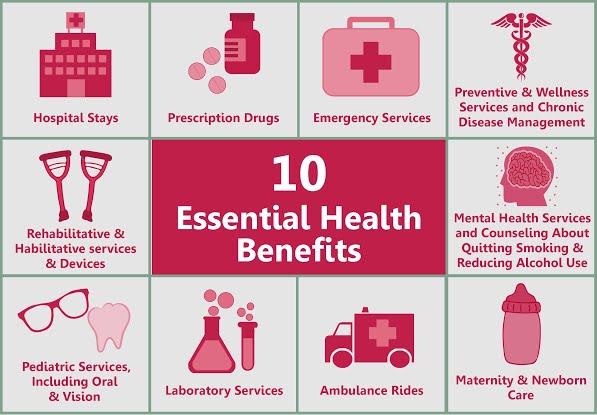

Covered: Essential Health Benefits

All health insurance plans sold through the marketplace must cover basic health benefits. These benefits make sure that all medical needs are covered and keep people from having to pay for unforeseen medical bills. Services usually include visits to the doctor, hospital stays, prescription drugs, maternity care, mental health care, emergency care, and preventative care.

This standard coverage ensures that everyone who buys health insurance will get a basic set of medical services, no matter which plan they choose. This makes it easier to compare and stops insurance companies from leaving out important advantages.

Getting to Know Premiums, Deductibles, and Costs

Cost is one of the most prevalent inquiries people have about the health insurance marketplace. Monthly premiums are the payments made every month to keep coverage. Deductibles are the amounts you have to pay out of your own wallet before your insurance starts to cover certain services. After the deductible is satisfied, you have to pay coinsurance and copayments.

People can compare these charges ahead of time in the health insurance marketplace. People can see how much they would have to spend for medical appointments, prescriptions, and hospital stays by looking at plan summaries. This openness helps customers pick the right coverage for their health care requirements and budget.

Help with Money and Subsidies

One of the best things about the health insurance marketplace is that it gives you access to financial help. People who qualify can get subsidies based on the size and income of their household. These subsidies lower monthly rates and, in some situations, deductibles and copayments.

When you apply for health insurance, the marketplace automatically figures out how much help you need. This makes sure that customers get the most money they can without having to deal with complicated paperwork. Subsidies make health insurance far more affordable for many families.

What Enrollment Periods Are

You can only sign up for health insurance through the marketplace during certain times. Every year, there is a significant enrollment window during which people can sign up for new coverage or adjust their current insurance. Outside of this time, registration is usually limited unless something happens in your life that makes you eligible.

Getting married, getting divorced, having a baby, losing your old coverage, or moving are all examples of qualifying occurrences. These events start a unique enrollment period, which lets people access the health insurance marketplace outside of the normal time frame.

How to Pick the Right Plan

You need to think carefully about the plan to choose in the health insurance marketplace. You should think about things like your medical history, your prescription needs, your favorite providers, and how often you plan to use healthcare. When you put plans next to each other, it’s easier to see which one is the greatest deal.

The health insurance marketplace makes it easier to compare rates and benefits by giving you standardized plan information. By carefully reading this material, people can avoid paying too much for benefits they don’t need or not enough for benefits they do need.

Health Insurance Marketplace vs. Coverage from Your Job

The health insurance marketplace and employer-sponsored insurance are not the same thing. Companies often pay for part of their employees’ health insurance, which lowers costs for the employees. But not everyone can get employer coverage, and some employer plans may not satisfy all of their healthcare needs.

The health insurance marketplace lets you choose your own plan and gives you freedom. People can pick plans that fit their needs instead of having to use the ones their employer picks. This flexibility is quite helpful for people who work for themselves or are shifting jobs.

Comparing Marketplace Plans and Employer Plans

| Feature | Health Insurance Marketplace | Employer-Sponsored Insurance |

|---|---|---|

| Plan Choice | Wide selection | Limited by employer |

| Subsidies | Income-based | Employer contribution |

| Portability | Independent of job | Tied to employment |

| Enrollment Flexibility | Annual and special periods | Employer schedule |

This comparison shows why a lot of consumers go to the health insurance marketplace when their company doesn’t offer enough options.

Coverage for Dependents and Families

Families can sign up for a single health insurance plan or choose separate coverage for each member through the health insurance marketplace. It can cover children, spouses, and other dependents, making it a good choice for families with different medical needs.

Family plans from the health insurance marketplace usually cover things like immunizations, pediatric care, and preventive care. This makes sure that growing families have full coverage and helps their health in the long term.

Things You Shouldn’t Do

When people shop for health insurance, they often make mistakes that could have been avoided. One mistake that many people make is merely looking at monthly premiums and without taking into account deductibles and out-of-pocket limits. Not checking provider networks is another mistake that might lead to increased costs if your preferred doctors are not in network.

You can avoid these problems by carefully going over the terms of your plan and being honest about your healthcare needs. The health insurance marketplace is meant to be open, but it’s still important to make smart choices.

Effect on Preventive and Long-Term Care

The health insurance marketplace encourages preventive care by offering many procedures at no extra cost. This makes people more likely to have frequent exams, get diagnosed early, and take charge of their health. This method lowers the need for costly emergency care over time and improves health outcomes in general.

Having insurance coverage all the time is also good for long-term care planning. People lower their chance of gaps that could cause financial problems by keeping their health insurance through the marketplace.

What will happen to the Health Insurance Marketplace in the Future

As healthcare demands and policies change, the health insurance marketplace keeps changing. The goal is to make the system easier to use by making digital tools better, plans more clear, and prices lower. As more people learn about it, more people are likely to use the health insurance marketplace to get the coverage they need.

For the health insurance marketplace to be successful in the long run, it needs to be affordable, make it easier for people to get treatment, and keep up with changes in healthcare needs. Its position in today’s healthcare systems is still quite important.

Conclusion

The health insurance marketplace is more than just a location to get coverage. It is a complete system that protects consumers, encourages preventative care, and makes sure that everyone can get the health care they need. The health insurance marketplace gives people the power to make their own healthcare decisions by giving them standard plans, financial help, and clear information.

People can choose health insurance with confidence and responsibility if they know how the marketplace operates. The health insurance marketplace is still one of the best ways for people, families, and self-employed professionals to get quality and cheap health insurance.

Read More:- Business Development Services: Strategies, Benefits, and Growth Opportunities